Quick: How much money did you spend on non-essentials last month? If you’re like most people, you aren’t sure. In a 2020 survey, 65% of respondents said they had no idea how much money they spent last month.

Not tracking your spending and income can cause you to overspend; in fact, Americans reported spending $2,100 on impulse purchases last year. And you risk not having enough money to pay your bills, causing you to miss payments and accrue late fees. Missing your payment due dates can even impact your credit score.

The solution? Creating and following a budget.

What Is a Budget?

The term “budget” can be intimidating. Many people think of budgets as restrictive or limiting, but they don’t have to be. A budget is simply an accounting of your expenses versus your income. It can be helpful to think of a budget as a spending plan or blueprint for how you’ll use the money you earn.

A budget has a few different purposes:

- It Tells You If You Make Enough Money for Your Lifestyle: When you create a budget, you should have more money coming in than you spend. Ideally, there should be a cushion as well. If you’re barely breaking even — or have a deficit — that’s a good indication you need to make changes.

- You Can Use a Budget to Figure Out If You Can Afford Your Goals: When you have a big decision, such as buying a car or taking out student loans, your budget tells you how much you can afford to spend.

- Budgets Can Help You Plan for the Future: Your budget is a powerful tool for your future. Adjusting your budget can help you achieve goals like buying a home, traveling, or retiring early.

How to Create a Budget from Scratch

If you don’t have a budget or don’t know where to start, don’t worry. Creating a budget is easier than you may think! Just follow these steps:

1. Write Down Your Monthly Take Home Income

Look at your bank statements or pay stubs to see how much money you bring in each month after taxes. If your income fluctuates from month to month, look up your income for each month from the past year and calculate an average.

Include income from all sources, including your full-time job, side hustle, investments, alimony, or Social Security benefits. If it’s money you regularly receive, it should be part of your budget.

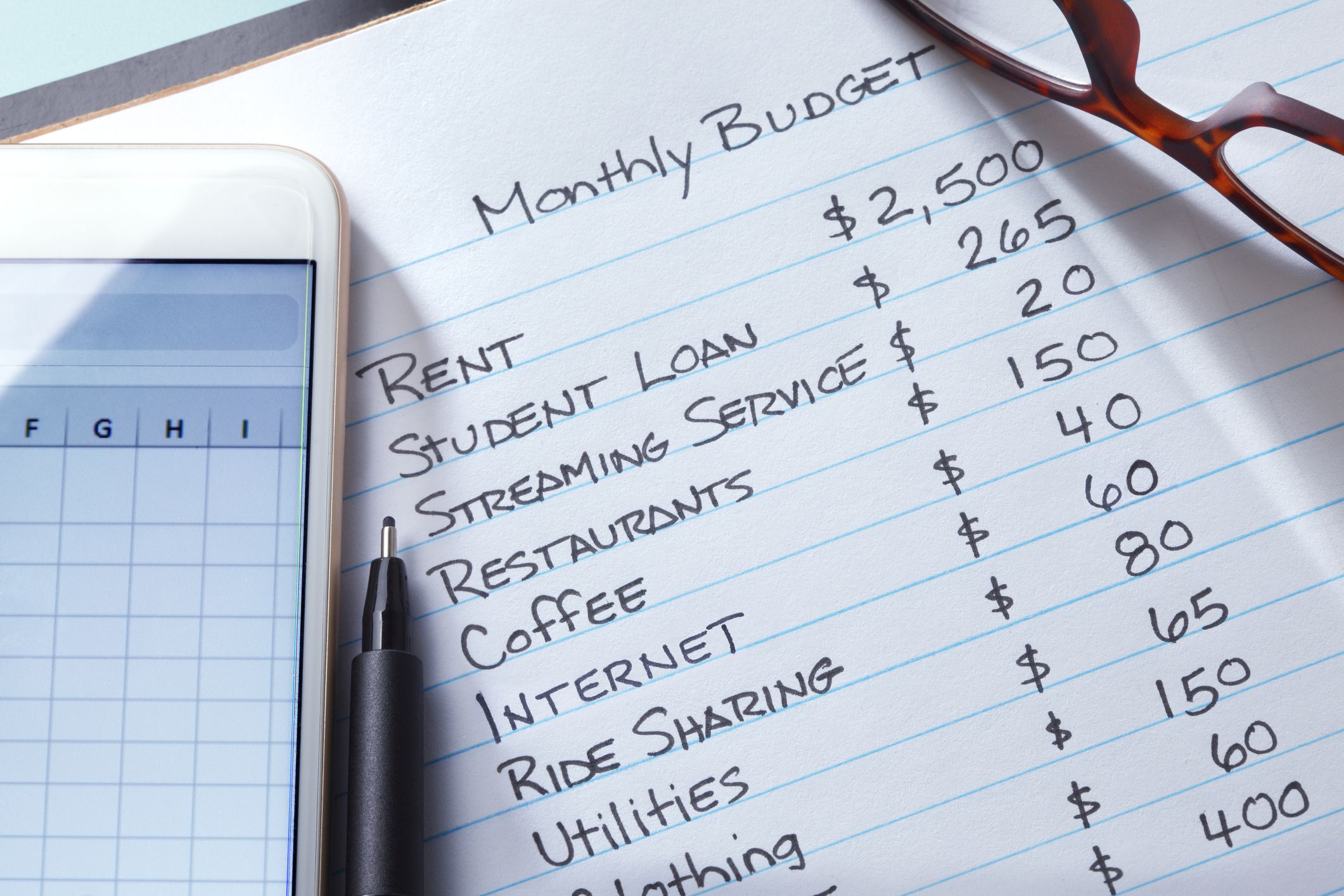

2. List All of Your Fixed Expenses

Next, list how much you spend on all of your fixed expenses – the expenses that stay the same every month. For example, the following expenses are fixed:

- Rent or mortgage payments

- Student loan payments

- Car payments

- Car insurance

- Health insurance premiums

- Cell phone bill

If you have expenses that you pay annually or quarterly, such as your car insurance premiums, make sure you account for those in your budget as well. Review what you pay per year, and split that amount up over 12 months so you set aside money for those expenses.

3. List Your Variable Expenses

Once you know your fixed expenses, think about your variable expenses. These are regular expenses you incur that may change from month to month. For example, utilities, groceries, clothing, gas, and personal care are all variable expenses.

To make sure you’re allocating enough money, look at your bank or credit card statements over the past 12 months. It will give you an idea of how much you spend on average on each category.

4. Allocate Money for Goals

After listing all of your expenses, you can allocate money toward your goals. Ideally, you should plan to set aside money for an emergency fund, retirement, and any other goals you may have. For example, if you want to buy a home in the future, plan to set aside some money for a down payment.

5. Plan for Some Extra Spending

It’s common to underestimate your spending, so it’s wise to plan for some unexpected, non-emergency expenses. A good rule of thumb is to tack on 10% of your take-home income onto your spending budget to avoid any surprises.

For example, if your take-home pay is $4,000 per month, add $400 to your expenses to give yourself some breathing room.

6. Identify Areas Where You Can Cut Back

After you’ve followed the above steps, review your budget. If you are spending more than you make, are just breaking even, or don’t have enough money to accomplish your goals, look for areas to cut back. Some areas where you may be able to make adjustments include:

- Housing: If your rent or mortgage payment is too high, consider downsizing to a smaller home. Or, think about getting a roommate to split your housing and utility costs.

- Food: If you regularly use delivery services or dine at restaurants, aim to cook more at home. Skipping just a few deliveries or restaurant meals per month can help you save hundreds.

- Entertainment: If you have multiple streaming services, cancel all but one or two of your favorites.

- Transportation: If your car payment is too high, consider selling your vehicle and getting an older, less expensive car. Or, you can carpool with coworkers to reduce your transportation costs.

Budgeting Strategies

There are multiple budgeting strategies you can use to manage your spending and plan for the future Some of the most popular strategies include:

Zero-Balance

The zero-balance budget is the traditional method you likely think of when you hear the word “budget.” You list all of your expenses and savings goals and set a target amount for each category. It gives every dollar you earn a job and helps you identify problem areas. However, it does require a good deal of monitoring and regular check-ins to make sure you stay on track.

50/30/20

With this method:

50% of your income is allocated for basic living expenses, like housing and groceries

30% of your money is set aside for wants, such as a vacation or a new laptop

20% of your income is dedicated to saving for the future, such as your retirement fund

This approach is best for those starting out in their careers or earning a relatively high salary, since for many people, slashing expenses to 50% of their income is impossible.

Cash Envelope

The cash envelope method is a great option if you have a tendency to impulse shop. With this approach, you cash your paycheck and sort the money into categorized envelopes, such as “food” or “rent.” Whenever you make a purchase, use the cash from that category’s envelope; once that money is spent, you can’t make any more purchases in that category unless you deduct that cash from another envelope.

Because it’s dealing with physical dollars, the cash envelope method can help you stay on track with your spending and rein in unnecessary purchases.

Managing Your Money

While you may be overwhelmed by the idea of creating a budget, it’s not as difficult as it may seem. Plus, using a budget is a great way to achieve your goals and reduce financial stress. Need help getting started? If you’re a SouthEast Bank customer, you can use our digital banking tools to track and categorize spending from your account. You can set monthly goals in different categories and monitor your progress online.

Note: Links to other websites or references to services or applications are provided as a convenience only. A link does not imply SouthEast Bank’s sponsorship or approval of any other site, service or application. SouthEast Bank does not control the content of these sites, services or applications.

Information contained in this blog is for educational and informational purposes only. Nothing contained in this blog should be construed as legal or tax advice. An attorney or tax advisor should be consulted for advice on specific issues.